Irs Tax Bracket 2025 Single Filer

Irs Tax Bracket 2025 Single Filer. If your income qualifies, you can deduct that entire $7,000. For a single taxpayer, the rates are:

Single people are allowed to contribute up to $7,000 for 2025 to a traditional ira. 2025 tax rates for other filers.

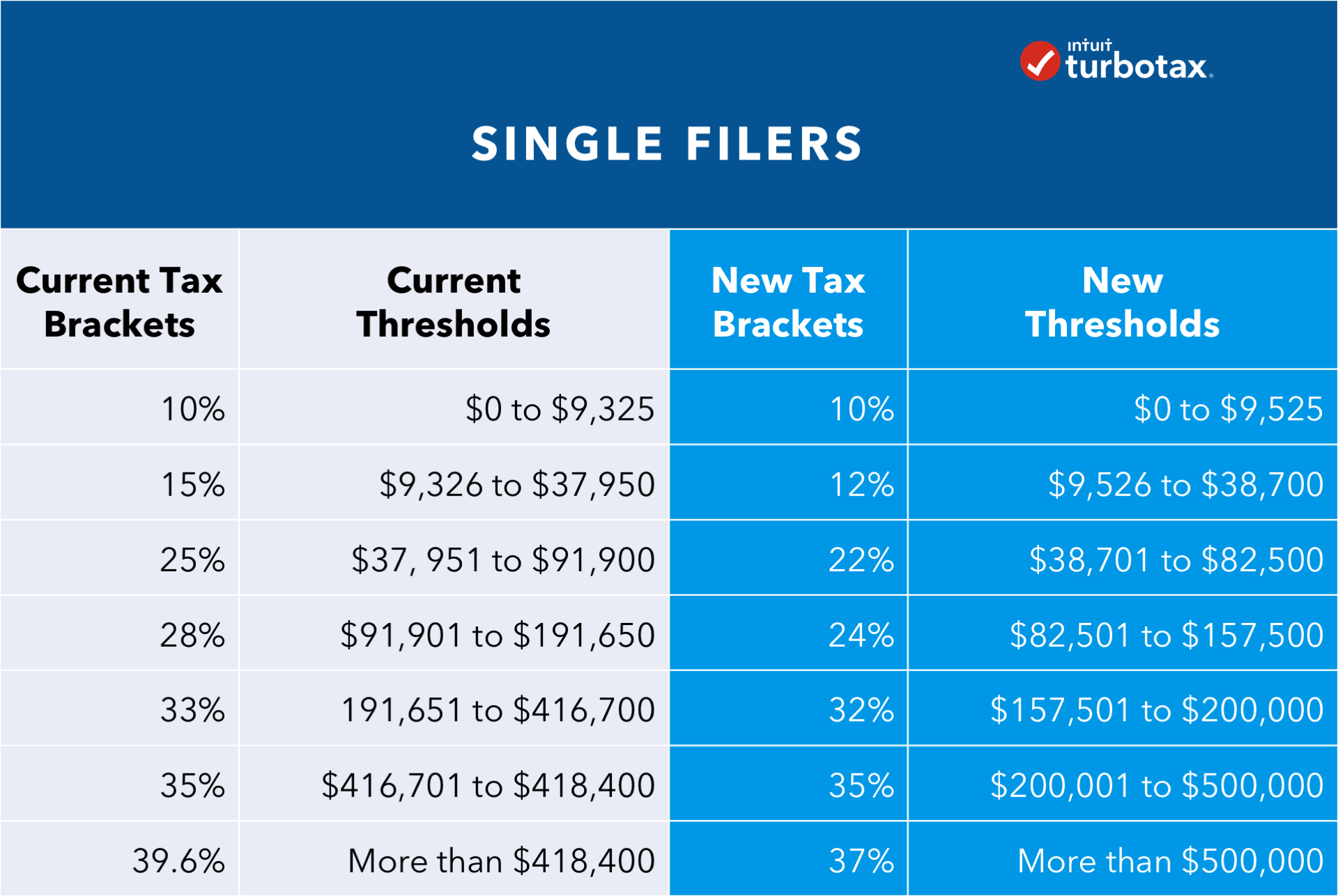

Irs New Tax Brackets 2025 Elene Hedvige, The federal income tax has seven tax rates in 2025: The next tax bracket is 12% of taxable income levels between $11,601 to $47,150.

Irs New Tax Brackets 2025 Elene Hedvige, Meanwhile, the lowest threshold of. Up to $11,600 (was $11,000 for 2025) — 10% more than $11,600 (was.

Irs Tax Brackets 2025 Married Filing Jointly Ambur Bettine, There are seven federal tax brackets for tax year 2025. Here’s how that works for a single person earning $58,000 per year:

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, Driving for work will pay more next year after irs. For 2025, the irs made adjustments to federal income tax brackets to account for inflation, including raising the.

When Will 2025 Tax Brackets Be Announced For Single Bridie Sabrina, The highest earners fall into the 37% range, while those. Income in america is taxed by the federal government, most state governments and many local governments.

2025 Tax Brackets Single Filer Tool Libby Othilia, Here's how those break out by filing status:. What are the changes in income thresholds for the 7 categories?

Irs 2025 Tax Brackets Vs 2025 Natty Viviana, The internal revenue service has released the. Find the current tax rates for other filing statuses.

Here are the federal tax brackets for 2025 vs. 2025, For instance, the 10% rate for a single filer is up to and including $11,000. Here’s how that works for a single person earning $58,000 per year:

Irs Tax Filing 2025 Viva Alverta, The irs is introducing new income limits for its seven tax brackets,. In addition, the standard deduction is $14,600 for single.

Tax filers can keep more money in 2025 as IRS shifts brackets Andrews, Here’s how that works for a single person earning $58,000 per year: What are the changes in income thresholds for the 7 categories?